Marketplaces and Scalability

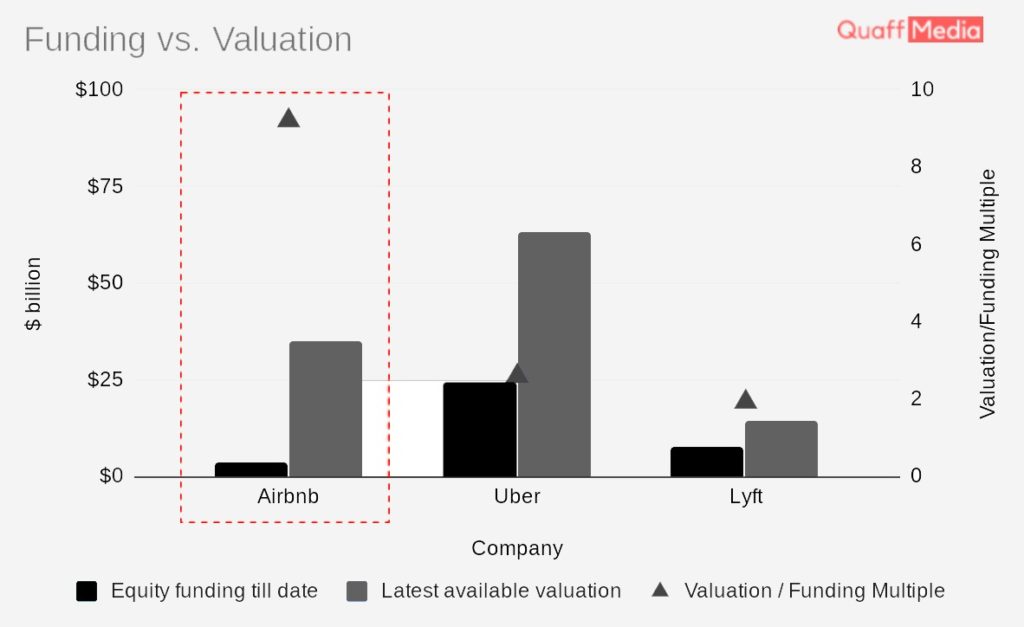

We all know that Uber and Airbnb are the two most iconic companies from the last decade. Originally, both companies were considered to be part of the same “sharing economy“, They created entirely new markets by using the marketplace model. Although they were both successful, Airbnb required far less funding than Uber (and Lyft) to create value.

A press report shows that Uber and Lyft are valued roughly 2-3 times the total equity funding raised, It also includes funds raised in their IPO. On the other hand, Airbnb is more capital efficient and is valued roughly 9-10 times the funding raised. In short, we can say that Airbnb created far more value than Uber and Lyft. This is something investors are really into as this affects the returns.

Besides being in the same “Sharing Economy” Uber and Airbnb are built on different models. Both have a self-reinforcing network effect, i.e., More suppliers, more the value of the product, and vice versa. They were both Silicon Valle founded and funded by Venture Capital. Here end the similarities between them.

Hyperlocal Network Effects

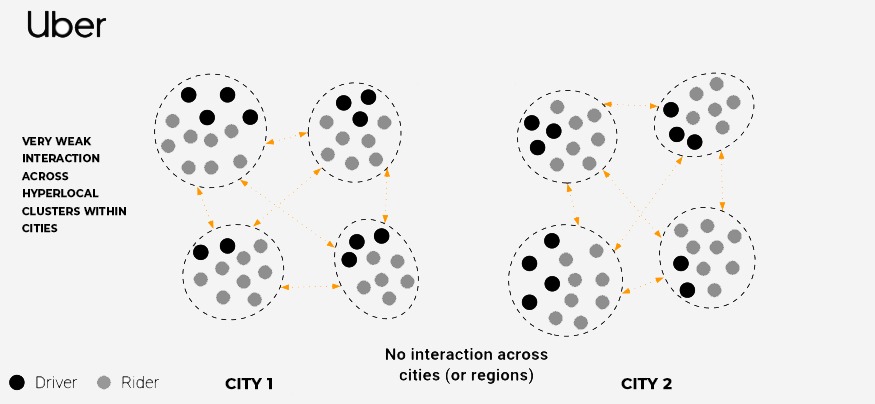

The hyperlocal network effect is the model on which Uber relies,i.e., The addition of a supply unit makes the product more valuable for the demand-side (a driver is a supply and a rider is the demand side). Drivers acquired by Uber help them in growing organically within the city.

Uber has to re-invest in driver acquisition when they want to expand in other cities. So if they have no drivers, they have no riders to get attracted organically (known as the “cold start” problem). Uber faced complications as its success catalyzed competitors and they created their local driver networks before Uber could.

It became expensive for Uber as the competitors had an established hyperlocal network effect. Eventually, Uber had to sell many of its regional units to local competitors.

As a result, The economics of units have less valuation-to-funding multiple, and scalability for hyperlocal marketplaces is also low.

Cross-Border Network Effects

Airbnb’s model is built on Cross-Border network effects, i.e., the addition of a supply unit makes the product more valuable for the demand side (supply unit is a host and demand side is a guest). For example, any new host in the USA could attract tourists visiting the city from anywhere in the world.

So when they decided to expand to other markets, it was easier for them as the demand from existing guests made it easy and cost-effective to attract hosts. In short, Unlike Uber, Airbnb did not have to re-invest to acquire customers as there were already existing customers out there. This way, Airbnb didn’t face the “cold start” problem.

Once they began to expand, they faced very little competition. This is the reason behind the immense economic scalability of Airbnb.

Convoy is another Great example of a cross-border network effect as it has a valuation-to-funding multiple of 4-5 times. Convoy connects shippers (Global Physical products shipping companies) to truckers (Who transport shipments to the destination).

If a unit of supply (a shipper) is added in New York, it makes the product more valuable for any shipper across the globe. So when Convoy expands to other countries, their existing customers can book truckers in the new market, helping to attract local truckers organically.

Numbrs

Numbrs is a mobile banking company that operates a financial marketplace in Germany, and it boasts a valuation-to-funding multiple comparatively equal to Airbnb.

Numbrs need to attract new suppliers when they expand, Because of the regulatory and licensing requirements for financial services firms. Adding a new supply will help attract users anywhere in the region.

Scaling financial marketplace is more efficient when compared to hyperlocal network effects, but when compared with Truly global marketplaces, it is less efficient. Thus we can expect a decline in its valuation-to-finding multiple when Numbrs expand to other geographies. But it will still be ahead of hyperlocal marketplaces.

Besides geographical restrictions, input to evaluate the potential of marketplace startups is critical to network effects. Frequency of transactions/interactions, marginal costs, multi-tenanting, side-switching, size of market adjacencies, supply differentiation, SaaS components, fragmentation of supply and demand, etc.

We will be discussing some of these intricacies in the future. Marketplaces with hyperlocal network effects tend to be less good bets than those with cross-border networks, assuming these factors remain equal.

Real-world communities or networks that already communicate or transact across geographic boundaries are good places to start looking for these types of marketplaces. Various sizeable industries like industrials and manufacturing deal with suppliers that are all over the world. Similar to that, markets like early-stage startup funding and financial services connect supply and demand with reasonably large geographical areas and markets.

We can not say that all hyperlocal marketplaces are bad investments. Local service-oriented marketplaces can address Key problems like childcare and elderly care. But on the other hand, To sustainably Address the market, hyperlocal network effects tend to shrink its size. If entrepreneurs working on these types of startups want to build a sustainable business, they have to identify the most realistic finding avenues based on pragmatic growth.