You must have wondered why only some marketplaces with the seemingly same functionality flourish whereas the others collapse in the wake of competition. What are some of the main factors which determine the stability of a marketplace? What can you, as a supplier, do to ensure the victory of your venture over the others? Let’s go through the following valuable points in detail and try to answer the above questions.

A few vital characteristics may act as the game changers for marketplaces. Even a slight shortcoming can turn the structural advantages into fatal risks.

Some of these key features include:

- The geographic range of network effects

- Supply differentiation

- SaaS integration

- Market fragmentation

Market Fragmentation

The subsequent second and third-level frameworks account for the defensibility and scalability of the market.

Nature of Engagement

Another vital and deciding factor that determines the prosperity of a marketplace is the nature of engagement, i.e., the size and frequency of transactions.

Let’s understand how it can become a fatal risk factor for some marketplaces. Based on the nature of engagement, these marketplaces can be classified as:

- Markets with lower transaction size

They are more prone to face the risk of unsustainable unit economics. Even to compensate for the amount spent, repeated transactions are a must. Furthermore, the transaction size must be satisfactory enough because you are here to gain profits after all.

- Markets with less frequent usage

The lesser the frequency, the more the chances of being wiped out in this competitive environment. If you interact rarely, there would be a greater risk of losing your valuable customers. But as said, exceptions do exist. Let’s take the example of Airbnb.

It comes under the category of markets with lower transaction frequencies, it’s used just once or twice a year but the quality and loyalty it provides to its customers are simply unmatchable. Its unique and exclusive supply base keeps its competitors out of the league.

You require an advanced level criterion to decide the fate of your organization.

CASE STUDIES

Impact of Engagement on Failed Marketplaces

First of all, don’t be afraid to take risks. It’s the innovation that distinguishes between a leader and a follower. Try to think out of the box and bring out your newest and original ideas. Remember, always the first movers take the credit even after being lower transaction groups whereas the copycats tend to fail miserably.

Instead of being the so-called copycats, wouldn’t it be a better idea to study the reasons for the failure of those first movers? Let’s take an example again.

It depicts the above scenario. Being the original, it always had the benefit of structure and executed its ideas well. Many copycats like Housetrip and WindyWimdu emerged and got failed in its wake.

It linked consumers to local couriers and packaging services. They made it rather convenient for its users by fulfilling the purpose just by asking them to enter the pickup place and destination along with a picture of the item. It made over 60 million dollars before its downfall.

It linked its consumers to local services providers like cleaners, plumbers, electricians, etc. It was able to gain over 60 million dollars before its downfall.

This venture enabled its users to book private chefs for their homes based on their tastes and choices. It made nearly 20 million dollars before failing.

As suggested by its name, wash.io provided the consumers the facility to book laundry and dry cleaning services online. Their clothes could be picked up and returned within 24 hours. It managed to raise 15 million dollars in venture capital funding before failing.

So, what do you observe? Were you able to spot any similarities between these start-ups?

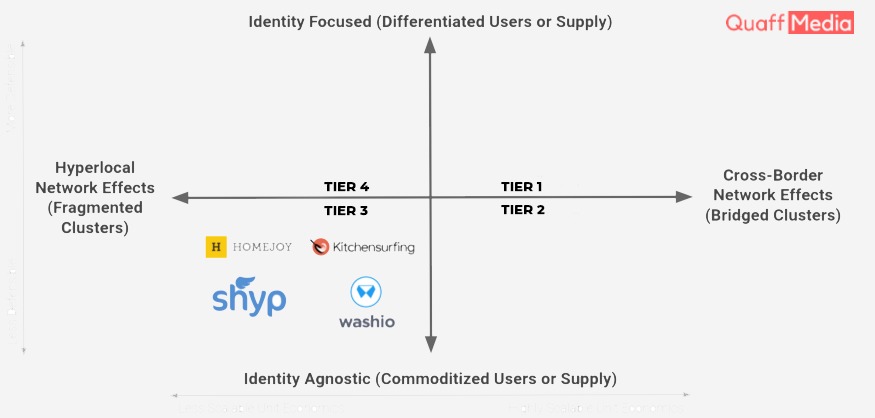

Yes, all of these can be classified as hyperlocal “Uber for X” marketplaces and that too without SaaS (Software as a service) integration. They can be seen as a collection of discrete individual marketplaces in each hyperlocal market. This drawback makes their scaling hectic and inefficient. On the other hand, marketplaces with commoditized supply experience higher multi-tenanting with certainly a higher number of consumers and suppliers at different levels.

But as stated “exceptions do exist” Have a look at Uber and Deliveroo. They are also tier-three marketplaces like Shyp and Homejoy. They lack SaaS integration. But still, they stand out of the queue. Despite facing several challenges, they have managed to tackle their shortcomings and rose to fame and glory.

What did they do differently to be in the position they are in today? What makes them unique in their way? Let’s find out.

Role of Engagement

Be it Shyp or Homejoy, kitchen surfing, or wash.io, all failed marketplaces have one thing in common. Here’s when the role of engagement becomes extraordinarily significant. In each of the above cases, funding was not a problem. So where did they lack? They lacked in unit economics.

In the first place, these ventures had low profits per transaction. Moreover, for expanding their business to new cities or new marketplaces, they couldn’t lower the customer acquisition costs. How? In a new city, they couldn’t leverage pre-existing supplies to attract customers in the new market. They had to spend in contacting and collaborating with the service providers in the new city to gain some customers there. This added to the major drawback of low profits per transaction which made it more inapprehensible to even recover their costs.

They tried to retain and attract new customers by providing discounts and offers, which increased the CAC even further, thus increasing the load on the company. Moreover, increasing competition on the top of already lower frequency of use led to a loss of many genuine customers. These ventures are the clear examples where the economics failed miserably, i.e., the mishap couldn’t be avoided and they were forced to shut down.

Another major challenge that can’t be avoided is extensive disintermediation. It occurs when the marketplace charges the suppliers more than the value it creates for them. This makes it even worse for the company to compensate their expenses and many of them are forced to shut down.

For instance, let’s take the case of Homejoy. Suppose a family finds a plumber suitable and worthy for their work through Homejoy. There are high chances that the next time, they may contact the plumber directly, thus eliminating the role of Homejoy. This happens when there is less diversity in the kind of services provided by the supply side.

So, the conclusion is that fewer transaction sizes and frequencies may prove fatal for the marketplaces that are unable to lower the customer acquisition costs over a while.

The Marketplace Matrix

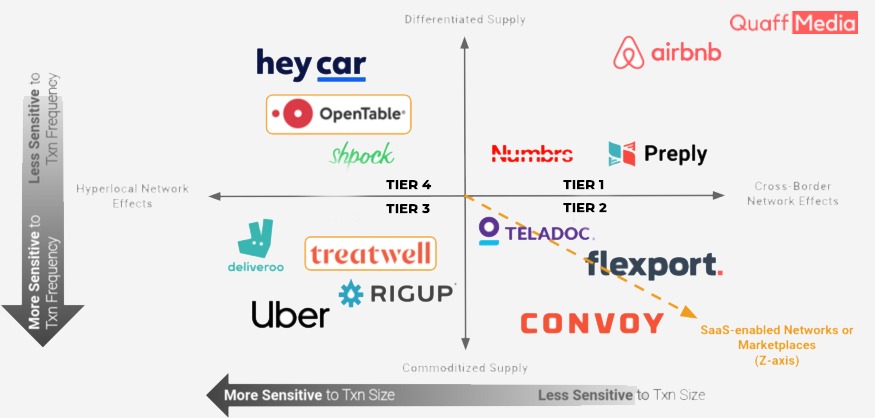

Tier-1 Marketplaces –

Organizations that were courageous to take the risk and think out of the box make it to the first-tier marketplaces. They have unique supplies and cross-border structures which make them less prone to face failure due to competition. Lower sizes and frequencies of transactions don’t affect them much and they’re able to lower the customer acquisition costs quickly and effectively. Ventures such as Airbnb, Numbrs, and Preply fall into this category.

Tier-2 Marketplaces –

Tier-2 marketplaces are very sensitive to either lower transaction size or its frequency. They face struggles and challenges to meet their expenses and at the same time fight their competitors but eventually, they tend to rise upon the ladder of success. Ventures such as Shpock and Teladoc fall into this category.

Tier-3 Marketplaces –

Most of the so-called failed or collapsed start-ups fall into this category. A set of challenges like commoditized supply, hyperlocal structures, and extensive disintermediation make them sensitive to both transaction size and frequency.

They are generally structurally weak and their main theme isn’t something original. They are mostly unable to recover their expenses and collapse eventually. Their viability is at a greater risk than the above two tiers. Ventures such as Uber, Deliveroo, Homejoy, wash.io, Getaround, etc. fall into this category.

Impact of SaaS Integration

It acts as a magic wand to tackle the challenges of small and infrequent transactions. It’s a boon to sensitive third-tier ventures and businesses. “Treatwell”, a third-tier start-up, has proven its worth in the market just by leveraging SaaS integration effectively to lower its expenses on the customers or simply the customer acquisition cost.

Conclusion

While the nature of transactions can’t be exactly controlled and has several complexities in itself, but it indeed can decide the fate of a marketplace. It becomes the question of life and death to some third-tier ventures. SaaS integration can act as a lifesaver here.

However, the nature and economics of transactions can’t solely determine how the company will perform and how well will it tackle its competitors. Several other structural factors such as the geographic range of network effects and supply differentiation also account for the stability of a marketplace.